The Sticker Shock of 2026

Kathryn, a 64-year-old retired teacher from Delaware, sat at her kitchen table staring at a piece of paper that didn’t make sense. For years, the monthly cost for her and her husband’s silver-tier health plan hovered around $350—a bill they could pay without dipping into savings. Unfortunately, the renewal notice in her hands painted a grim picture for 2026. To keep the exact same coverage, their premium wasn’t just going up; it was exploding to nearly $3,000 a month.

“He kept saying, ‘You’re doing something wrong,'” Kathryn told reporters at WHYY, referring to her husband. She wasn’t. She was simply the latest casualty of the “Subsidy Cliff.”

Kathryn is the canary in the coal mine. Her panic mirrors the new economic reality slamming into millions of American households this year. The safety net of the pandemic-era Enhanced Premium Tax Credits (EPTC) evaporated at the end of 2025. Combine that loss with a projected 6.5% to 18% spike in underlying healthcare costs—fueled by the insatiable demand for GLP-1 weight-loss drugs and aggressive hospital consolidation—and 2026 shapes up to be the most hostile year for consumers in a decade.

The margin for error has vanished. Choosing the wrong plan this year isn’t a paperwork annoyance; it is a financial landmine.

The 2026 Landscape: Why You’re Bleeding Cash

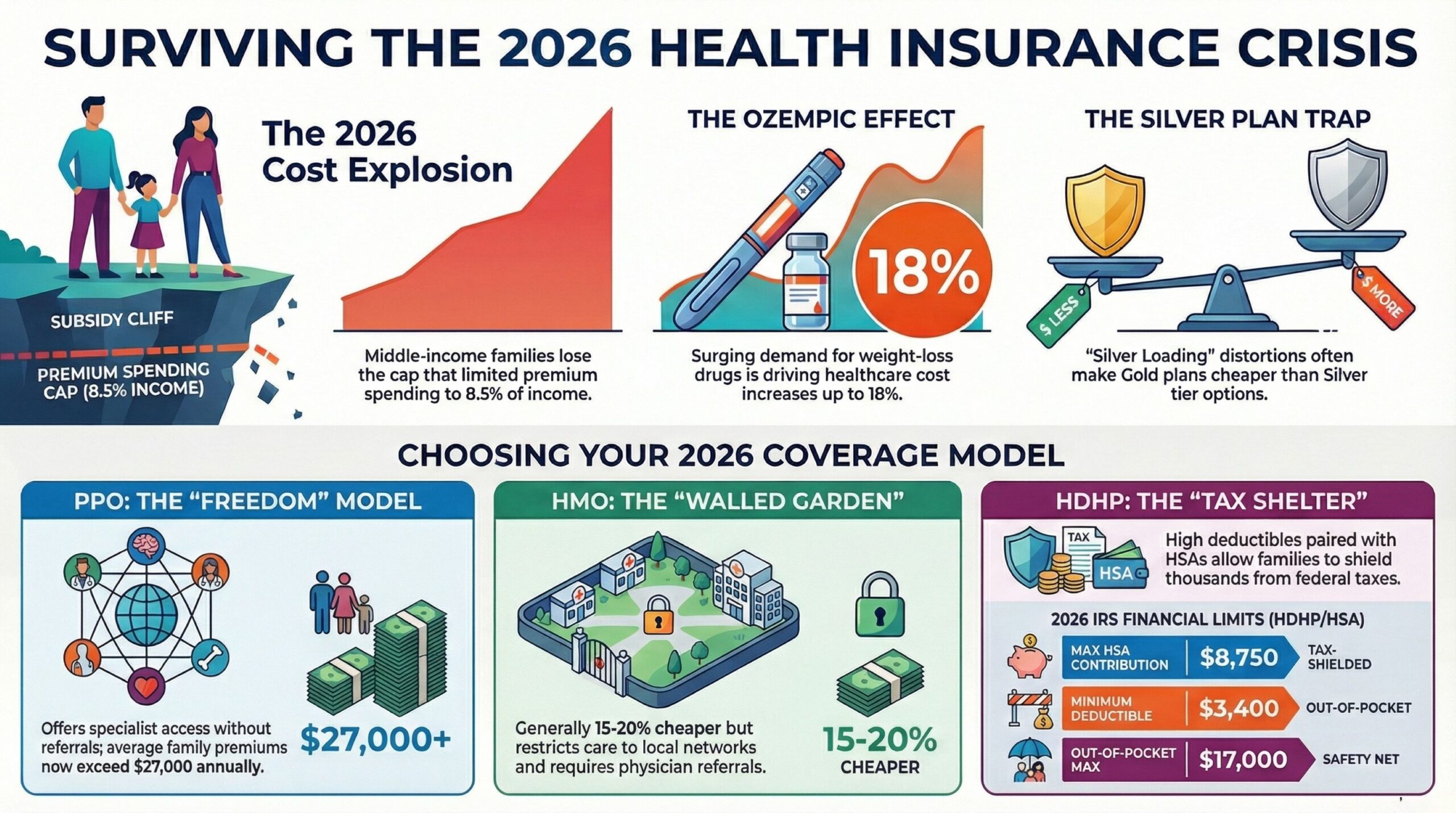

To survive this market, you need to understand the machinery grinding up your bank account. The price hike isn’t random bad luck; it’s a collision of three specific forces:

1. The Subsidy Cliff: When the American Rescue Plan’s enhanced subsidies expired, the ceiling came crashing down. Middle-income families (earning over 400% of the Federal Poverty Level) are no longer protected by the cap that limited premium spending to 8.5% of income. In states like Maine, early data screams a warning: a 32% spike in plan cancellations because people simply can’t pay.

2. The Ozempic Effect: In 2025, coverage for GLP-1 agonists (like Wegovy and Zepbound) jumped to 43% of large employers. These drugs work wonders clinically, but they are budget-busters. Insurers are responding with blunt force: raising premiums for everyone to spread the risk.

3. The Stealth Tax (Deductible Creep): Insurers know you shop based on the monthly premium. To keep that number optically palatable, they have quietly jacked up deductibles. The average family deductible has drifted upward, offloading more “first-dollar” risk onto your personal credit card.

The Big Three: PPO, HMO, and HDHP

In this volatile climate, there is no “best” plan. There is only math. You need to pick the model that aligns with your family’s biological reality.

1. The PPO (Preferred Provider Organization)

The “Pay for Freedom” Model

The Mechanism: PPOs are the VIP pass of healthcare. No referrals for specialists. Coverage (albeit reduced) for out-of-network doctors. You pay for the privilege of not asking permission.

2026 Status: PPOs are bleeding the most. For a family of four, the average employer-sponsored PPO premium has breached the $27,000 mark annually. Employees are now seeing roughly $6,850 deducted directly from their paychecks just to keep the lights on.

Best For: The complex cases. If you have children seeing multiple specialists, or if you split time between states, you need this. If your child has type 1 diabetes or severe asthma, the administrative nightmare of an HMO isn’t worth the savings. Buy the PPO.

2. The HMO (Health Maintenance Organization)

The “Walled Garden” Model

Structural Constraints: Think of this model as a “gilded cage.” You stick strictly to a specific network. Your Primary Care Physician (PCP) serves as the gatekeeper, meaning you cannot see a cardiologist or dermatologist without a referral. Step outside the network, and you cover 100% of the bill, unless it is a life-threatening emergency.

2026 Status: As PPO prices spiral, families are flocking back to HMOs. They generally run 15-20% cheaper. The catch? Network adequacy is crumbling. With hospital systems merging, some 2026 HMO networks are dangerously thin.

Best For: The homebodies and the healthy. If your medical history is a blank page and you rarely leave your zip code, an HMO caps your bleeding effectively.

3. The HDHP (High-Deductible Health Plan) with HSA

The “Casino” Model (With a Tax Break)

The Mechanism: A financial instrument wrapped in medical paperwork. You accept a massive deductible. In exchange, you get lower premiums and the keys to a Health Savings Account (HSA).

2026 IRS Limits (Crucial Update):

* HSA Contribution Limit: $8,750 for families (up from $8,550).

* Minimum Deductible: $3,400 for families.

* Out-of-Pocket Maximum: $17,000 for families.

The Math: This is the only place the government cut families a break. sheltering $8,750 pre-tax is potent. For a family in the 24% tax bracket, maxing out the HSA instantly deletes $2,100 in federal taxes.

Best For: The extremes.

1. The Iron Man: You never get sick. You treat the HSA like a second 401(k).

2. The Planned Surgery: Paradoxically, if you know you will hit the max (e.g., a scheduled hip replacement), an HDHP often wins because the monthly premiums are so much lower than a PPO.

Deep Dive: The “Silver Plan” Trap

If you shop on the ACA Marketplace (Healthcare.gov), pay attention. The metal tiers—Bronze, Silver, Gold, Platinum—are lying to you.

For 2026, the Silver Tier is a financial sinkhole for middle-income earners. Historically, Silver plans carried “Cost Sharing Reductions” (CSRs). But with subsidies gone, the unsubsidized price of Silver has ballooned. A 40-year-old is looking at an average of $752/month.

The Reality Check:

We are seeing a bizarre market distortion called “Silver Loading.” Insurers have baked the extra costs into Silver premiums, making Gold plans cheaper than Silver in many counties.

* Action: Do not auto-renew. Check the Gold tier. You might find a lower deductible and a lower premium.

The Hidden Costs: Deductibles vs. Out-of-Pocket Max

The rookie mistake? You are fixating on the premium, effectively treating it like monthly rent. However, this narrow focus means you are ignoring the Total Cost of Risk.

Case Study: The Martinez Family

* The Setup: Parents + 2 kids. Tried to save cash with a Bronze plan.

* Premium: $400/month ($4,800/year).

* Deductible: $14,000 (Family).

* Co-insurance: 40% after deductible.

* The Accident: Son breaks an arm at soccer. Surgery required. Bill: $12,000.

* The Damage: They hadn’t touched their $14,000 deductible. They owed the hospital $12,000 cash.

* The “What If”: A Gold plan ($800/month, $3,000 deductible) would have cost them $9,600 in premiums + $3,000 deductible + 20% of the balance ($1,800). Total: $14,400.

* The Verdict: In a bad year, the “expensive” Gold plan cost roughly the same as the “cheap” Bronze plan plus the fracture—but the Gold plan would have kept covering them for the rest of the year. The Bronze plan left them exposed.

The Rule of Thumb: If you don’t have $5,000 sitting in a savings account, you cannot afford a Bronze plan. You are one bad tackle away from insolvency.

Network Adequacy: The “Ghost Network” Problem

Unfortunately, a sinister trend for 2026 is the “Ghost Network.” In fact, these are insurer directories stuffed with doctors who are retired, dead, or haven’t accepted a new patient since 2022.

The Detective Work:

Trust nothing on the insurer’s website. Before you sign:

1. Pick your “Must-Haves” (Pediatrician, OB/GYN).

2. Call the front desk.

3. Ask specifically: “Do you accept [Specific Plan Name] for 2026?” Many docs take “Blue Cross PPO” but slam the door on “Blue Cross Select HMO.”

Carrier Analysis: The Major Players

Observations from the trenches, not endorsements.

* UnitedHealthcare: They are pushing “virtual first” hard. Your PCP is an app. It’s cheap, but if you hate Zoom calls, stay away.

* CVS Health (Aetna): The strategy here is integration. If you live near a CVS MinuteClinic, this offers convenience for the small stuff (strep tests, flu shots) without the wait times.

* Elevance Health (Anthem/Blue Cross): Massive networks, but they are fighting with hospitals. 2026 has been plagued by contract disputes that leave patients temporarily “out-of-network” while the giants bicker over rates.

* Cigna: Aggressively courting employers with pharmacy integration. They are trying to put a lid on the GLP-1 cost explosion.

Clinical Outlook: Your Wallet is a Vital Sign

As clinicians, we see the stress. High cortisol from debt anxiety doesn’t just keep you up at night; it inflames the very conditions you’re paying to treat.

In 2026, health insurance isn’t just about access; it’s about asset protection. The training wheels are off. You need to approach open enrollment with the skepticism of a forensic accountant.

The Survival Guide:

1. Calculate Total Liability: (Monthly Premium x 12) + (Family Out-of-Pocket Max). Write this number down. It’s your worst-case scenario.

2. Feed the HSA: If you go HDHP, fund the account. An empty HSA is just a high deductible with no tax benefit—a raw deal.

3. Check the Formulary: On Wegovy or insulin? Check the “Tier.” For example, if your drug moved from Tier 2 to Tier 3, you could be staring at an extra $2,400 a year.

The era of “set it and forget it” is dead. In 2026, the best health plan is the one that protects your body without bankrupting your future.

Sources:

Employee Benefit Research Institute. GLP-1 Coverage and Its Impact on Employment-Based Health Plan Premiums: A Simulation-Based Analysis. EBRI. Published October 9, 2025. Accessed February 10, 2026.

Internal Revenue Service. Rev. Proc. 2025-19. IRS. Accessed February 10, 2026.

KFF. ACA Insurers Are Raising Premiums by an Estimated 26%, but Most Enrollees Could See Sharper Increases in What They Pay. KFF. Published October 28, 2025. Accessed February 10, 2026.

KFF. Annual Family Premiums for Employer Coverage Rise 6% in 2025, Nearing $27,000, with Workers Paying $6,850 Toward Premiums Out of Their Paychecks. KFF. Published October 22, 2025. Accessed February 10, 2026.

KFF. Explaining Cost-Sharing Reductions and Silver Loading in ACA Marketplaces. KFF. Published June 2, 2025. Accessed February 10, 2026.

Disclaimer: This article is intended for informational purposes only and does not constitute medical advice. Ultimately, always consult with a qualified healthcare professional for any health concerns. Consequently, please prioritize this step before making any decisions related to your health or treatment.